Details

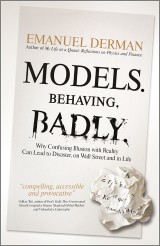

Models. Behaving. Badly.

Why Confusing Illusion with Reality Can Lead to Disaster, on Wall Street and in Life1. Aufl.

|

17,99 € |

|

| Verlag: | Wiley |

| Format: | |

| Veröffentl.: | 13.10.2011 |

| ISBN/EAN: | 9781119944683 |

| Sprache: | englisch |

| Anzahl Seiten: | 240 |

DRM-geschütztes eBook, Sie benötigen z.B. Adobe Digital Editions und eine Adobe ID zum Lesen.

Beschreibungen

Emanuel Derman was a quantitative analyst (Quant) at Goldman Sachs, one of the financial engineers whose mathematical models became crucial for Wall Street. The reliance investors put on such quantitative analysis was catastrophic for the economy, setting off the ongoing string of financial crises that began with the mortgage market in 2007 and continues through today. Here Derman looks at why people -- bankers in particular -- still put so much faith in these models, and why it's a terrible mistake to do so. <p>Though financial models imitate the style of physics and employ the language of mathematics, ultimately they deal with human beings. There is a fundamental difference between the aims and potential achievements of physics and those of finance. In physics, theories aim for a description of reality; in finance, at best, models can shoot only for a simplistic and very limited approximation to it. When we make a model involving human beings, we are trying to force the ugly stepsister's foot into Cinderella's pretty glass slipper. It doesn't fit without cutting off some of the essential parts. Physicists and economists have been too enthusiastic to acknowledge the limits of their equations in the sphere of human behavior--which of course is what economics is all about.</p> <p><i>Models.Behaving.Badly</i> includes a personal account of Derman's childhood encounters with failed models--the oppressions of apartheid and the utopia of the kibbutz. He describes his experience as a physicist on Wall Street, the models quants generated, the benefits they brought and the problems, practical and ethical, they caused. Derman takes a close look at what a model is, and then highlights the differences between the successes of modeling in physics and its failures in economics. Describing the collapse of the subprime mortgage CDO market in 2007, Derman urges us to stop the naïve reliance on these models, and offers suggestions for mending them. This is a fascinating, lyrical, and very human look behind the curtain at the intersection between mathematics and human nature.</p>

<b>I. MODELS</b> <p>1. A Foolish Consistency 3</p> <p>2. Metaphors, Models, and Theories 33</p> <p><b>II. MODELS BEHAVING</b></p> <p>3. The Absolute 73</p> <p>4. The Sublime 107</p> <p><b>III. MODELS BEHAVING BADLY</b></p> <p>5. The Inadequate 139</p> <p>6. Breaking the Cycle 189</p> <p>Appendix: Escaping Bondage 201</p> <p>Acknowledgments 205</p> <p>Notes 207</p> <p>Index 217</p>

<b>EMANUEL DERMAN</b> is Head of Risk at Prisma Capital Partners and a professor at Columbia University, where he directs their program in financial engineering. He is the author of <i>My Life As A Quant</i>, one of Business Week's top ten books of the year, in which he introduced the quant world to a wide audience.<br /> He was born in South Africa but has lived most of his professional life in Manhattan in New York City, where he has made contributions to several fields. He started out as a theoretical physicist, doing research on unified theories of elementary particle interactions. At AT&T Bell Laboratories in the 1980s he developed programming languages for business modeling. From 1985 to 2002 he worked on Wall Street, running quantitative strategies research groups in fixed income, equities and risk management, and was appointed a managing director at Goldman Sachs & Co. in 1997. The financial models he developed there, the Black-Derman-Toy interest rate model and the Derman-Kani local volatility model, have become widely used industry standards.<br /> In his 1996 article <i>Model Risk</i> Derman pointed out the dangers that inevitably accompany the use of models, a theme he developed in <i>My Life as a Quant</i>. Among his many awards and honors, he was named the SunGard/IAFE Financial Engineer of the Year in 2000. He has a PhD in theoretical physics from Columbia University and is the author of numerous articles in elementary particle physics, computer science, and finance.

<b>Praise for Models.Behaving.Badly.</b> <p>"Emanuel Derman has written my kind of book, an elegant combination of memoir, confession, essay on ethics, philosophy of science, and professional practice. He convincingly establishes the difference between model and theory and shows why attempts to model financial markets can never be genuinely scientific. It vindicates those of us who hold that financial modeling is neither practical nor scientific. Exceedingly readable."<br /> —<b>NASSIM N. TALEB</b>, author of <i>The Black Swan</i></p> <p>"This is a compelling, accessible, and provocative piece of work that forces us to question many of our assumptions. As Derman explains so clearly, models are not 'bad' in themselves; on the contrary, they are crucial for modern society. However, they have been used in a dangerously sloppy and careless way, with sometimes terrible results. Derman explains this clearly and draws heavily on his own lifetime experience—ranging from growing up in apartheid South Africa to working in the scientific field and then as a financial engineer on Wall Street—to provide a moving and fascinating set of illustrations of these principles. The conclusion is unexpectedly optimistic—if people choose to listen."<br /> —<b>GILLIAN TETT</b>, author of <i>Fool's Gold</i></p> <p>"An engaging and personal meditation on the limitations of our ability to predict the future, especially—but not only—in the context of financial markets. He is not interested in blame or politics, but in the deeper lessons to be drawn from the financial crisis. As a physicist who was also highly placed in the financial world, he explains clearly the difference between prediction and advice, theory and model, and knowledge and wisdom."<br /> —<b>LEE SMOLIN</b>, senior researcher at Perimeter Institute for Theoretical Physics; author of <i>The Trouble with Physics</i>, <i>The Life of the Cosmos</i>, and <i>Three Roads to Quantum Gravity</i></p> <p>"If you don't want your models to behave badly, you should study carefully these words of wisdom on the philosophy of quantitative modeling. Emanuel Derman has always been one of the most respected quants on Wall Street. Now he has proven that he is also one of the most thoughtful. Though in the sequel he should tell us what happened to the large man over the Sudan!”<br /> —<b>CLIFFORD S. ASNESS</b>, PhD, managing and founding principal, AQR Capital Management</p>

Diese Produkte könnten Sie auch interessieren:

Counterparty Credit Risk, Collateral and Funding

von: Damiano Brigo, Massimo Morini, Andrea Pallavicini

69,99 €

Risk Management for Islamic Banks

von: Imam Wahyudi, Fenny Rosmanita, Muhammad Budi Prasetyo, Niken Iwani Surya Putri

55,99 €