Details

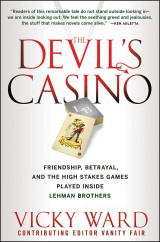

The Devil's Casino

Friendship, Betrayal, and the High Stakes Games Played Inside Lehman Brothers1. Aufl.

|

10,99 € |

|

| Verlag: | Wiley |

| Format: | |

| Veröffentl.: | 26.03.2010 |

| ISBN/EAN: | 9780470638217 |

| Sprache: | englisch |

| Anzahl Seiten: | 296 |

DRM-geschütztes eBook, Sie benötigen z.B. Adobe Digital Editions und eine Adobe ID zum Lesen.

Beschreibungen

<b>The inside story of what really happened at Lehman Brothers and why it failed</b> <p>In The Devil's Casino: Friendship, Betrayal, and the High Stakes Games Played Inside Lehman Brothers, investigative writer and Vanity Fair contributing editor Vicky Ward takes readers inside Lehman's highly charged offices. What Ward uncovers is a much bigger story than Lehman losing at the risky game of collateralized debt obligations, swaps, and leverage.</p> <p>A can't put it down page turner that opens the world of Wall Street to view unlike any book since Bonfire of the Vanities, except that The Devil's Casino isn't fiction.</p> <ul> <li>Details what went on behind-the-scenes the weekend Lehman Brothers failed, as well as inside Lehman during the twenty years preceding it</li> <li>Describes the feudal culture that proved both Lehman's strength and its Achilles' heel</li> <li>Written by Vicky Ward, one of today's most connected business and finance writers</li> </ul> <p>On Wall Street, Lehman Brothers was cheekily known as "the cat with nine lives." But as The Devil's Casino documents, this cat pushed its luck too far and died?the victim of men and women blinded by arrogance.</p>

Cast of Characters. <p>Prologue.</p> <p><b>Part One: The Ponderosa Boys.</b></p> <p>Chapter 1. A Long, Hot Summer.</p> <p>Chapter 2. The Beginning.</p> <p>Chapter 3. The Captain.</p> <p>Chapter 4. The “Take-Under”.</p> <p>Chapter 5. Slamex.</p> <p>Chapter 6. The Phoenix Rises.</p> <p>Chapter 7. Independence Day.</p> <p>Chapter 8. The Stiletto.</p> <p>Chapter 9. The Ides of March.</p> <p>Chapter 10. Eulogies.</p> <p><b>Part Two: The Echo Chamber.</b></p> <p>Chapter 11. Russian Winter.</p> <p>Chapter 12. Lehman’s Desperate Housewives.</p> <p>Chapter 13. The Young Lions.</p> <p>Chapter 14. 9/11.</p> <p>Chapter 15. No Ordinary Joe.</p> <p>Chapter 16. The Talking Head.</p> <p>Chapter 17. The Sacrificial Ram.</p> <p>Chapter 18. Korea’s Rising Sum.</p> <p>Chapter 19. The Wart on the End of Lehman’s Nose.</p> <p>Chapter 20. Damned Flood?</p> <p>Chapter 21. Closing the Books.</p> <p>Epilogue.</p> <p>A Note About the Sources.</p> <p>Notes.</p> <p>References.</p> <p>Acknowledgments.</p> <p>Index. </p>

"Contains some fascinating pen-portraits of Lehman's characters—Mr Fuld and his sycophantic court . . . ." (<i>The Economist Online</i>) <p>"Ward sheds light on the four childhood friends who planned to take the financial world by storm while keeping their heads on their shoulders, and how quickly the second part of the play fell by the wayside amidst a brutal corporate coup and bumbling mismanagement that brought the firm down. <i>The Devil's Casino</i> serves as both an impressive work of investigative journalism and a cautionary tale of the culture surrounding American finance." (<i>The Daily Beast</i>)</p> <p>"Ward's book is rich on details . . . when Ward connects the dots, the rough conclusion she comes up with is that fatal flaws of Fuld's culture brought Lehman down." (<i>Reuters</i>)</p> <p>"A fascinating, deftly paced tale." (<i>Metro.co.uk</i>)</p> <p>"<cite>Vanity Fair</cite> Contributing Editor Vicky Ward serves up a book about an investment bank that is a spicy, dishy dish . . . Ward builds a convincing case that duplicity and betrayal in the mid-'90s eventually led to the demise of Lehman Brothers." (<i>Bloomberg BusinessWeek</i>)</p> <p>"…<i>The Devil's Casino</i> has everything readers might want to know about the personal foibles and shopping habits of key Lehman leaders and their wives…a fascinating read." (<i>Financial Times</i>)</p> <p>"What's remarkable about this narrative is that Ward...manages to humanize many of the central figures involved in the rise and fall of one of Wall Street’s largest firms, offering profound insight into the titans of finance whose recklessness, greed, and competitiveness brought the US economy to the brink of collapse. The story plays out like a Shakespearean tragedy (Ward even includes a "Cast of Characters") in which the very principles upon which the firm was built prove to be its undoing. . . <i>The Devil's Casino</i>. offers a fascinating glimpse into the culture of one of the most powerful firms on Wall Street. One hopes that the history it chronicles will also serve as a cautionary tale for the financial industry's still-uncertain future." (<i>The Boston Globe</i>)</p> <p>"In a terrific book Vicky Ward takes us into the heart of the denial machine. Hers is the story of Lehman Brothers, then Wall Street's fourth largest investment bank, soon to be its biggest casualty. . . Ward takes us into the world of these bankers, and shows us the lives they were leading in the years before the crash. At first, they saw themselves as "good guys" – bankers who would not become blinded by greed. But then they began to see how much money could be made and their lifestyles changed. They did not seem to be their old selves any more. This is what Ward does so well: she shows us the world of private jets and helicopters, the women with personal shoppers and shelves full of unworn shoes. She shows us how it is that people, even though they are multi-millionaires, can still have an addict's desperation for money." (<i>The Guardian</i>)</p> <p>In the fall of 2008, the 150-year-old financial institution Lehman Brothers spectacularly melted down. The liquefied remains then ignited, joining the worldwide conflagration that became the great recession that is now either over or not, depending on whom you talk to. In short order, a host of formerly rock-solid institutions showed cracks that ran all the way from their foundations to the aeries occupied by their greedy, ineffective senior management. Firms that once represented all that was trustworthy in our financial system teetered, then fell. Even insurance companies that were responsible for the welfare of others were revealed to be the oldest permanent floating craps game in New York.</p> <p>"Vicky Ward's "The Devil's Casino" is an able new entrant into this crowded genre, and people who hate losers who are not their friends should enjoy it very much. It chronicles the sad and messy end of the House of Lehman in a relatively terse and fast-moving 270 pages, making it a mere social X-ray of a book by today's standards of nonfiction heft, which often rivals the unsecured debt load of a failed bank. Ward carefully and skillfully tracks the last 25 or so years of the great, doomed enterprise, and her portrait of a business entity is often engaging, spicy and amusing. I particularly enjoyed the horror stories about those few, strategically challenged souls who had the temerity not to learn golf. Theirs was a demise that only outsiders to our fascist corporate golfing culture can appreciate. And the tick-tock of deals, fads, decisions and transactions that took place over a very long time can be exciting. The book also does a fine job of sketching several outlandishly banal individuals who rose to prominence in the firm and ultimately were responsible, each in a different way, for its demise." (<i>The Washington Post</i>)</p> <p>"Vicky Ward is a British export to New York, with a degree in English Literature – and it shows. She writes stylishly and she understands, unlike other authors who have rushed into print with accounts of the financial crisis, that enduring literature is not created by unravelling transactions but by illuminating complex personalities." (<i>Mail on Sunday</i>)</p> <p>“Vicky Ward's <i>The Devil's Casino</i> is an able. entrant into this crowded genre, and people who hate losers who are not their friends should enjoy it very much. It chronicles the sad and messy end of the House of Lehman in a relatively terse and fast-moving 270 pages. Ward carefully and skillfully tracks the last 25 or so years of the great, doomed enterprise, and her portrait of a business entity is often engaging, spicy and amusing. The book also does a fine job sketching several outlandishly banal individuals who rose to prominence in the firm and ultimately were responsible, each in a different way, for its demise.” <i>(Stanley Bing, The Free Press)</i></p> <p>“A terrific tale of the weird and not‑so‑wonderful world of Lehman Brothers: the personalities, the bonuses, and best of all the backstabbing politics of the Louboutin-shod bankers' Wags. The now-vilified former CEO, Richard Fuld , is portrayed not just as the aggressive "Gorilla" of Wall Street lore but as a human sponge who absorbed the attributes of smarter colleagues to the point of stealing their entire personality.” <i>(The Guardian)</i></p> <p>“The Devil’s Casino, well researched, chatty, lively, sets itself up as a successor to Greed and Glory on Wall Street, Ken Auletta’s 1986 book about Lehman. But the clichés of business articles are too frequent here: standing ovations on the trading floor, the rich wife’s shoe collection and so on. . . as she charts the rivalries of life on Wall Street, Ward entertains with rich detail: the rough-edged Fuld taking elocution lessons and copying the nail-clipping habits of a smoother senior whose job he desires; Henry Kissinger at a board meeting, stirring his iced tea with a pencil. Ward shows that more than two decades ago, Lehman was developing dodgy habits that would cause trouble later. For example, it used a secret cash cushion known as “Dick’s reserve” to polish its results at the end of each quarter. The book skillfully depicts the lives lived in the background of great clashing events. And it also hints at what Wall Street has become since the crisis, at the apparent dominance of two survivors, Goldman Sachs and JPMorgan Chase.” <i>(The New York Times)</i></p>

<p><b>VICKY WARD</b> has been a contributing editor to Vanity Fair since 2001, specializing in investigative reporting. She has profiled, among others, Jean-Marie Messier, Carly Fiorina, CIA agent Valerie Plame, businesswoman Louise MacBain, Morgan Stanley, the late Bruce Wasserstein, counterterrorism expert Richard Clarke, François Pinault, the Getty, the Guggenheim, Fairfield Greenwich Group (a Madoff feeder fund), Brooke Astor, and Kate Moss. Ward is a columnist for the <em>Huffington Post</em> and a former contributor to CNBC and Bloomberg TV. She was previously the executive editor of <em>Talk</em> magazine. Her work has appeared in the <em>New York Times</em>, the <em>Financial Times</em>, the <em>London Times</em>, and the <em>Daily Telegraph</em>. A native Briton, Ward was the runner-up for the Catherine Pakenham Award in 1994, Britain's most prestigious award for young women writers. She holds a master's degree in English literature from Cambridge University and has lived in New York City since 1997.

<p>PRAISE FOR THE DEVIL'S CASINO <p>"Readers of this remarkable tale do not stand outside looking in—we are inside looking out . . . the stuff that makes novels come alive."</br> <b>—KEN AULETTA</b> <p>"Ward carefully and skillfully tracks the last 25 or so years of [this] great, doomed enterprise, and her portrait of a business entity is often engaging, spicy, and amusing. The book also does a fine job of sketching several outlandishly banal individuals who rose to prominence in the firm and ultimately were responsible, each in a different way, for its demise."<br> <b><i>—The Washington Post</i></b> <p>"What's remarkable about this narrative is that Ward . . . humanize[s] many of the central figures involved in the rise and fall of one of Wall Street's largest firms, offering profound insight into the titans of finance whose recklessness, greed, and competitiveness brought the U.S. economy to the brink of collapse. The story plays out like a Shakespearean tragedy in which the very principles upon which the firm was built prove to be its undoing. <em>The Devil's Casino</em> offers a fascinating glimpse into the culture of one of the most powerful firms on Wall Street. One hopes that the history it chronicles will also serve as a cautionary tale for the financial industry's still-uncertain future."<br> <b><i>—The Boston Globe</i></b> <p>"A terrific tale of the weird and not-so-wonderful world of Lehman Brothers: the personalities, the bonuses, and, best of all, the backstabbing politics of the Louboutin-shod bankers' WAGs. The now-vilified former CEO, Richard Fuld, is portrayed not just as the aggressive 'Gorilla' of Wall Street lore but as a human sponge who absorbed the attributes of smarter colleagues to the point of stealing their entire personalities."<br> <b><i>—The Guardian</i></b> <p>"Well researched, chatty, lively . . . As she charts the rivalries of life on Wall Street, Ward entertains with rich detail. The book skillfully depicts the lives lived in the background of great clashing events. And it also hints at what Wall Street has become since the crisis, at the apparent dominance of two survivors, Goldman Sachs and JPMorgan Chase."<br> <b><i>—The New York Times</i></b> <p>"Vicky Ward serves up a book about an investment bank that is a spicy, dishy dish. . . . Ward builds a convincing case that duplicity and betrayal in the mid-'90s eventually led to the demise of Lehman Brothers."<br> <b><i>—Bloomberg BusinessWeek</i></b> <p>"<em>The Devil's Casino</em> has everything readers might want to know about the personal foibles and shopping habits of key Lehman leaders and their wives…a fascinating read."<br> <b><i>—Financial Times</i></b>

"There is more juicy, salacious, icky stuff in this book than you can put in five books . . I kind of like all the icky stuff in it . . . all of the stuff going on with the wives and that. And sex and drugs. . . I'm begging you to read this. It reads like an intellectual Jackie Collins novel."<br /> —<b>Don Imus</b> <p>“The really juicy details behind the Lehman Bros. collapse. Behind-the-scenes account skips geeky economic discourse to examine the underlying history of backstabbing and greed that helped bring down the investment bank. It is not often that a book on the financial crisis makes you want to get a big bowl of popcorn. But Vicky Ward's page-turning yarn about Lehman Bros., the failed investment bank, is the closest thing to a bodice-ripper that the 2008 meltdown is likely to produce. . . . Ward writes about helicopter rides and corporate jets, multimillion-dollar art collections and constant backbiting. . . But for all the book's apparent fluffiness, Ward hones in on Lehman's central problems better than even she could have known. In a series of incidents stretching back decades, she shows how Lehman's traders routinely hid the riskiness of their trades from senior managers and the public. . . To Ward, the rest of the tale is an unstoppable operatic tragedy, albeit one that took 12 years to play out. But it is chock-full of designer clothes and fancy yachts that make for a fascinating read.”<br /> —<b>Los</b> <b>Angeles Times</b></p>

Diese Produkte könnten Sie auch interessieren:

Counterparty Credit Risk, Collateral and Funding

von: Damiano Brigo, Massimo Morini, Andrea Pallavicini

69,99 €